Dfs Value Calculator

Posted : admin On 4/16/2022

Dfs Value Picks

About Stock's Value

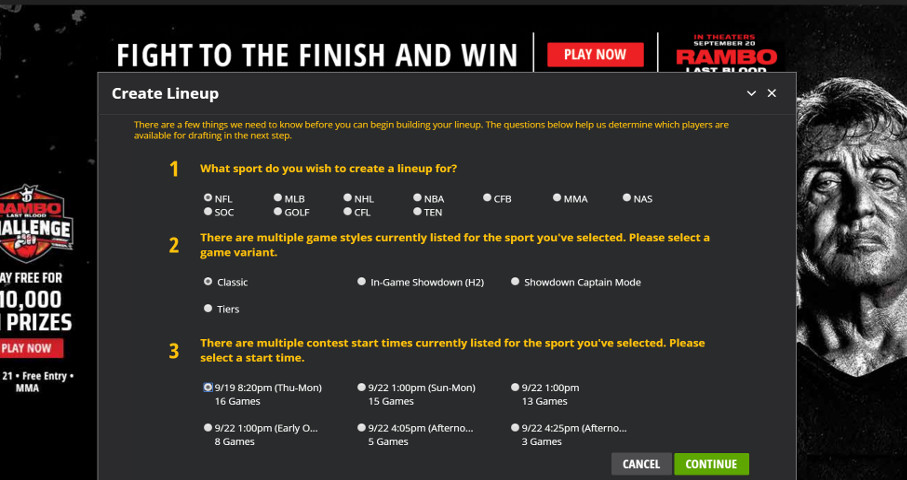

This expected value calculator helps you to quickly and easily calculate the expected value (or mean) of a discrete random variable X. Enter all known values of X and P (X) into the form below and click the 'Calculate' button to calculate the expected value of X. Find the best value plays for every DraftKings Classic slate. Part of the All-Access Membership Plan.

Dfs Value Calculator Formula

A stock could be overbought or oversold and it could be over-priced (overvalued) or udder-priced (undervalued). Overbought-oversold condition is defined by technical analysis. Over-priced, under-priced stock's value is calculated from the fundamental data.

There are several ways to calculate a value of a stock and each fundamental analyst will show you his/her own way. All these calculations are subjective and could be argued whether they are correct. There is no standard way to do it. If you are not a professional fundamental analysts, you could get easily lost in the calculations of the real and expected stock's value.

In DFS fundamental analysis the DFS stocks intrinsic value could be calculated in a simple way by using the Benjamin Graham's formula. This is the easiest way to get a stock's value based on the current Earnings Per Share (EPS) and PEG Ratio (Price/Earnings Growth). Again, while the EPS is a reported number, the PEG Ratio is estimated by the analysts from Reuters or other investment rating company and it is an approximate expected earnings growth. Respectfully, the Benjamin Graham's formula does not guarantee a correct stock's value - it is an approximate number expected by the professional analysts. Should something change a stock's earnings growth expectation it will affected the expected value of a stock.

The Benjamin Graham's Formula is

Intrinsic Value = EPS x (8.5 + 2 x PEG) x 4.4 / Yield

If you are mid- or long-term investors, it always a good idea to combine technical analysis with elements of fundamental analysis. You may expect better returns when you buy under-price (by fundamentals) and oversold (by technicals) stock or when you sell short overpriced (by fundamentals) and overbought (by technicals) stock.